Transform your mortgage post-closing process

Declining mortgage origination revenue is driving operational cost reductions and third-party outsourcing

Challenge

US mortgage originators are experiencing reduced loan volumes and less revenue due to higher interest rates and intense competition. The Mortgage Bankers Association reported that independent mortgage banks and mortgage subsidiaries of chartered banks lost $1,972 on each loan they originated in the first quarter of 2023. Losses, along with an intensifying regulatory environment, an emerging hybrid workforce, and pressure to reduce operational costs, are leading companies to outsource their physical footprint and find automated solutions to streamline and digitise processes.

Managed services solution

Accelerate outsourcing of a cost-effective and automated mortgage post-close process

Remain compliant and maintain collateral security with our end-to-end mortgage post-closing managed service offering. Made up of expertly trained teams, digital mortgage accelerator processes, and an intelligent softwareas- a-service (SaaS) technology platform called Iron Mountain InSight®, this bundled offering gives you the opportunity to:

- Reduce and scale opex costs in line with revenue streams

- Improve loan quality and delivery timelines to investors

- Unlock valuable knowledge from your data for new revenue-generating activity

- Maintain investor and regulatory compliance by driving quality

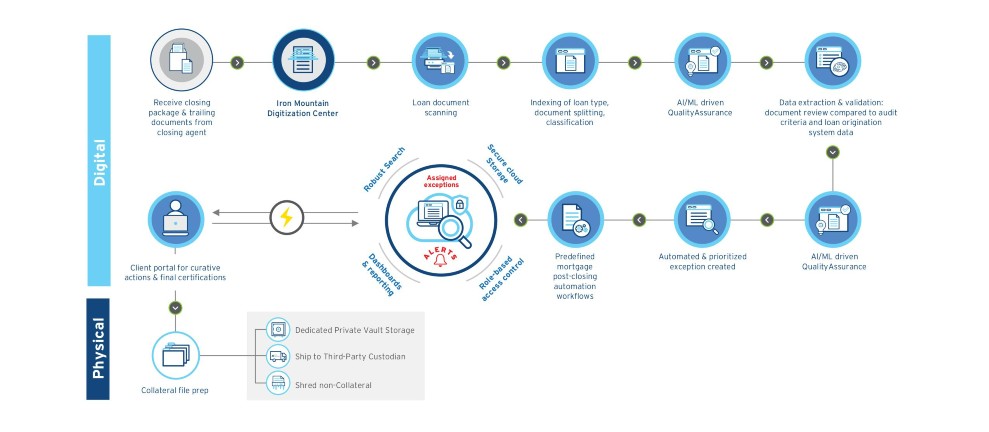

How it works

End-to-end secure and auditable chain of custody to protect and preserve your business value.

What you gain

Business results from an experienced and trusted partner — we are a proven mortgage post-closing managed services provider that enabled a major credit union to:

- Improve its efficiency with shortened cycle times

- Achieve scalable YOY growth

- Reduce its loan review costs, minimise buyback risk, and cost-effectively create a digitised process

Acceleration of your digital transformation — Our service offering enables your organisation to:

- Securely and cost-effectively digitise, store, automate, and unlock key collateral loan documents

- Automate the document-centric post-closing processes with intelligent workflows and exception handling using artificial intelligence and machine learning that adhere to compliance requirements

- Unlock value from the dashboards and reporting information, accelerating your loan pool certification process and salability into the secondary market

Related resources

View More Resources